Noticias

Noticias sobre Nintendo 3DS

La nueva actualización de Nintendo 3DS renueva el sentido de la amistad

Y es que cuantos más amigos tengas en tu Plaza Mii, mejor te irá en los cuatro nuevos juegos de StreetPass disponibles para adquirir en Nintendo eShop

Madrid, 20 de junio de 2013. Si tener tu Plaza Mii de StreetPass llena hasta la bandera te conseguía cromos, héroes y, sobre todo, calmaba un poco tu ansia coleccionista, la nueva actualización de la consola ya disponible lleva este hobby a un nuevo nivel. Con la nueva actualización, que entre otras cosas te permitirá cambiar la expresión de tu Mii cuando te cruces con otros usuarios vía StreetPass, podrás adquirir cuatro nuevos juegos para la Plaza Mii: StreetPass Squad, StreetPass Garden, StreetPass Battle y StreetPass Mansion.

Tú eliges a qué quieres jugar este verano sin necesidad de llevarte un cartucho de por medio. Y todo gracias a StreetPass: En StreetPass Squad los jugadores se podrán lanzarse contra los enemigos con la ayuda de los jugadores que te encuentres vía StreetPass. StreetPass Garden retará a los jugadores a plantar un jardín de flores y a polinizarlo con las plantas de tus visitas a través de StreetPass. En StreetPass Battle deberás reclutar un escuadrón, y conocer a otros caballeros con los que tendrás que conquistar el mundo. En StreetPass Mansion permitirá a los jugadores a diseñar y explorar una mansión gracias a las habitaciones que se desbloquearán a medida que te cruces con los personajes Mii. Y si avanzas en estos cuatro juegos podrás desbloquearon outfits para tu Mii.

Además, a partir de esta actualización, si guardas los datos de todo el software de Nintendo 3DS y la consola Virtual obtendrás una copia de seguridad. Descarga gratuitamente la última actualización de Nintendo 3DS a partir de hoy.

50 Frases de Mouwata durante su mandato en Nintendo

1. “No soy un presidente más, soy campeón de E3. Podéis llamarme ‘The Casual One’”.

2. “Si hubiera querido un trabajo fácil, me hubiera quedado en HAL con una cómoda silla azul, el trofeo de GOTY, Dios, y después de Dios, yo”

3. “Siempre es difícil perder para quien no está acostumbrado”

4. “2010 fue el mejor año de mi trayectoria. Si hay que poner una nota desde el punto de vista profesional, de 1 a 10 me pongo un 11″

5. “Dios tiene que pensar que soy un tío cojonudo. Si no, no me hubiera dado tanto”

6. “Si ni siquiera Jesucristo caía bien a todo el mundo, imagínate yo”

7. “No soy el mejor del mundo, pero creo que no hay nadie mejor que yo”

8. “En un mundo hipócrita, no ser hipócrita es un gran defecto. Es un defecto que yo tengo y que voy a tener siempre”

9. “A mí no me gusta la prostitución intelectual, me gusta la honestidad intelectual”

10. “Las victorias tienen muchos padres y las derrotas solo uno: yo”

11. “Un amigo mío dice que con todas las piedras que lanzan contra mí se podría hacer un monumento”

12. “Lo que digo no son quejas, son verdades”

13. “Llega a Nintendo un pobre presidente sin títulos y lo matan”

14. “Miyamoto ya puede ir por las oficinas de Sony tranquilo, porque ahora el enemigo público número uno soy yo”

15. “¿100 victorias con Nintendo? ¡No! ¡Me estás engañando, no puede ser! Revisa las estadísticas, con los palos que me meten… Serán 50, no 100″

16. “Una cosa es ser hardcore y otra ser jarcor”

17. “Cuanto más conozco Nintendo, más me parece que hay Nintenderos disfrazados”

18. “Mirad mi corte de pelo. ¡Estoy preparado para la guerra!”

19. “Eiji Kondo es una de esas personas que en Inglaterra llaman voyeur. Le gusta mirar a otras personas”

20. “Kaz Hirai lleva tres años sin ganar ningun E3 o tokyo game show. No creo que yo todavía tuviese trabajo”

21. “Masahiro Sakurai hizo algunas declaraciones sin demostrar madurez ni respeto, tal vez tiene que ver con una infancia difícil, sin la educación apropiada”

22. “No soy responsable de que Nintendo no haya ganado creado sagas nuevas desde hace 50 años. Solo soy responsable de no haberlas creado desde que entré”

23. “Puedo trabajar más pero lo que no puedo hacer son milagros. No soy Merlín o Harry Potter”

24. “Hoy, mañana y siempre, con Sony en el corazón”

25. “He estudiado inglés cinco horas al día durante varios meses para poder comunicarme bien con vosotros en los Nintendo Direct. Hideki Konno ha estado en Inglaterra durante cinco años y todavía le costaba decir buenos días y buenas noches“.

26. “No conozco a Pito Gates”

27. “¿Ese Kojima dónde trabaja? Lo buscaré en Google”

28. “Si me echaran de Nintendo, nunca me iría a Ubisoft. Me iría a un grande como Capcom o Valve”

29. “¿Si la PS Vita me preocupa? Mirad qué ojeras que tengo; no duermo por las noches”

30. “Aspiro a cambiar la filosofía en los videojuegos, no existen presidentes con las mismas ideas”

31. “Por suerte, en este mundillo hay más personas inteligentes que no inteligentes. Por eso he dirigido a HAL, , Rare y, ahora, a nintendo”.

32. “Bonito, bonito no es presidir Nintendo, no lo es mandar en Nintendo, es ganar con Nintendo”

33. “Takao Shimizu es un óptimo programador, pero parece que estemos hablando de Yoshinori Ono o Yoshio Sakamoto”

34. “Si no tienes ultra ball para ir a cazar y tienes pokeballs baratas, vas con las baratas”

35. “Saldré al escenario yo solo 40 minutos antes del E3. Y si la gente me quiere pitar, que me pite a mí y durante el E3 apoye a Nintendo”

36. “Tengo mejor relación con mi mujer que con Miyamoto”

37. “Si a mí me hacen lo mismo que en Tokyo Game Show, les pongo una cruz y conmigo están muertos”

38. “Monster Games tiene que decidir si es más importante terminar cuarto en Segunda o ayudar a la progresión de un programador”

39. “¿Si tengo envidia de Pep Kutaragi? ¡Ja, ja, ja! ¡Me haces reir!” (a una periodista)″

40. “Vi a Microsoft entrar en el vestuario de EA Games durante el descanso del E3 y no me lo podía creer”

41. “¿Don Mattrick dice que no soy un ejemplo para los jóvenes? No recuerdo que un equipo mío que haya perdido y mis rivales no hayan han podido celebrar en el E3 porque habían activado los aspersores”

42. “Pep Kutaragi no necesita hablar de Mouwata porque ya lo hacen sus empleados”

43. “Bill Gates ha sacado una consola que a mí me daría vergüenza”

44. “Hay tres tipos de presidentes: un grupo muy pequeño de presidentes que nunca critican los errores de las third parties; uno grupo muy grande, en el que estoy yo, que critica los errores de las third parties; y un nuevo grupo, en el que por el momento sólo está Sony, que critica el acierto de las third parties”

45. “Para Nintendo, vender más consolas que nadie en Japón es un sueño. Para Sony es una obsesión, es antinintendismo”

46. “Será difícil ganar la generación si los rivales de Microsoft le regalan los DLC”

47. “Parece que hay algunas compañias que tienen un control absoluto sobre el horario del E3″

48. “(a Miyamoto) Por ti debo trabajar a las doce, porque a las diez llegas dormido y a las once sigues durmiendo»

49. “Hay gente más inteligente que yo, que intenta tener otra imagen diferente a la mía, pero son iguales que yo”

50. “Los cincuenta DLC de Activision no han valido para nada”

Nuevas imágenes de Pikmin 3

Hoy traemos nuevas imágenes de la aventura de Pikmin 3, ya sabemos que habrán nuevos personajes y nuevos tipos de Pikmins (tipo roca y volador). Mientras el juego llega al mercado podemos hacernos un poco de boca con estas nuevas imágenes y el vídeo mostrado en el último Nintendo Direct capturado por los compañeros de GameXplain. El juego llegará a España el 26 de Julio.

Ranking juegos de 3DS, lista de Metacritic

Ya que Steam publica oficialmente las notas de los juegos otorgadas por Metacritic, nos ha parecido buena idea acceder a esta web para obtener el ranking de 3DS. No hemos puesto las listas enteras, creemos que poniendo los títulos más populares ya es suficiente, pero sí queréis ver todo, acceded a su web .

.

2011

94 The Legend of Zelda: Ocarina of Time 3D

90 Super Mario 3D Land

90 Pushmo

85 Super Street Fighter IV: 3D Edition

85 Mario Kart 7

83 VVVVVV

82 Cave Story 3D

82 Skylanders: Spyro’s Adventure

81 Star Fox 64 3D

79 Mighty Switch Force!

79 Shin Megami Tensei: Devil Survivor Overclocked

78 Tom Clancy’s Ghost Recon: Shadow Wars

77 3D Classics: Kirby’s Adventure

77 Bit.Trip Saga

75 Ridge Racer 3D

75 Nano Assault

2012

93 Cave Story

89 Zero Escape: Virtue’s Last Reward

88 Crashmo

86 Kid Icarus: Uprising

83 Professor Layton and the Miracle Mask

82 Resident Evil: Revelations

82 Art of Balance Touch!

82 Art Academy: Lessons for Everyone

81 Mutant Mudds

80 ZEN Pinball 3D

79 The Denpa Men: They Came By Wave

78 Metal Gear Solid: Snake Eater 3D

78 Theatrhythm Final Fantasy

78 Fluidity: Spin Cycle

78 New Super Mario Bros. 2

78 3D Classics: Kid Icarus

77 Ketzal’s Corridors

76 Crimson Shroud

76 Rhythm Thief & the Emperor’s Treasure

76 Style Savvy: Trendsetters

76 Tales of the Abyss

75 Paper Mario: Sticker Star

75 Kingdom Hearts 3D: Dream Drop Distance

75 escapeVektor

75 NightSky

2013

92 Fire Emblem: Awakening

85 Luigi’s Mansion: Dark Moon

84 Etrian Odyssey IV: Legends of the Titan

81 Gunman Clive

79 Monster Hunter 3 Ultimate

78 Super Little Acorns 3D Turbo

78 Mario and Donkey Kong: Minis on the Move

76 Shin Megami Tensei: Devil Summoner – Soul Hackers

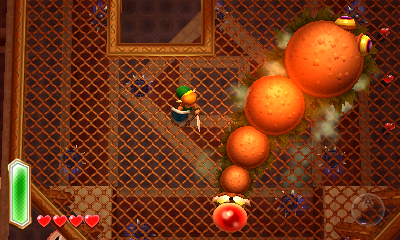

Imágenes del nuevo Zelda para Nintendo 3DS

- 21 de noviembre de 1990, sale The Legend of Zelda: A Link to the Past a la venta en Japón.

- 2 de diciembre de 2002, sale The Legend of Zelda: A Link to the Past & Four Swords a la venta en Norte América.

- 24 de abril de 2011, a Miyamoto le interesa ver un remake de Zelda SNES.

- 4 de noviembre de 2011, un nuevo Zelda está en desarrollo para Nintendo 3DS.

- 17 de abril de 2013, se desvela oficialmente el nuevo Zelda ambientado en el mundo de A Link to the Past para Nintendo 3DS.

- Estará a la venta a finales de 2013.

Resumen Nintendo 3DS Direct – 17-4-2013

- Mario & Luigi: Dream Team Bros. se estrena el 12/7.

- Compite este verano con gente del todo el mundo en torneos mundiales multijugador con Mario Golf: World Tour.

- Mario Party, este invierno en Nintendo 3DS.

- Descárgate este verano New Super Luigi U y convierte los 82 niveles de New SUPER MARIO BROS. U en una nueva aventura protagonizada por Luigi.

- Nuevas imágenes de Donkey Kong Country Returns 3D con el modo nuevo y un mundo entre las nubes.

- Yoshi y Bebé Mario regresan en un nuevo juego de Yoshi’s Island para Nintendo 3DS.

- Mario and Donkey Kong: Minis on the Move llega el 9/5, solo para eShop de Nintendo.

- La actualización de primavera de WiiU tendrá lugar la semana que viene: menores tiempos de carga + nuevas funcione.

- La semana que viene es el lanzamiento de la consola virtual de Wii U con juegos de NES y SNES.

- Nuevo en WiiU la semana que viene: Panorama View. Tours individuales y demo gratuita en Nintendo eShop.

- El Pikmin alado llega a Pikmin3. Puede transportar objetos por el aire… ¡Será de gran ayuda!

- EarthBound llegará a la consola virtual de WiiU a finales de este año.

- ¡Para celebrar el lanzamiento este viernes de FireEmblem: Awakening, el primer mapa de contenido adicional será gratis durante un mes!

- Averigua de qué va LEGO City Undercover: The Chase Begins para Nintendo 3DS con este nuevo tráiler: http://ow.ly/k9opO

- ¡Llega a Europa una edición especial de Nintendo 3DS XL con Animal Crossing: New Leaf preinstalado!

- ¡The Legend of Zelda: Oracle of Ages y Oracle of Seasons llegan a la consola virtual de Nintendo 3DS el 30/5!

- LEVEL-5 ofrecerá en breve 3 nuevos juegos de la serie Guild en eShop de Nintendo 3DS

- ¡Shin Megami Tensei IV, desarrollado por Atlus en exclusiva para Nintendo 3DS, llega a Europa!

- El profesor Layton regresará este año a Nintendo 3DS protagonizando Professor Layton and the Azran Legacy

- Disfruta de este vídeo de Bravely Default (título provisional). Llegará a Nintendo 3DS este año.

- Regresa al mundo de A Link to the Past con un nuevo juego Zelda y una nueva historia para Nintendo 3DS a finales de 2013

- ¡Visita la eShop de Nintendo 3DS para ver el nuevo The Legend of Zelda en 3D!

FIFA 14 se muestra

Tras un abrumador éxito entre crítica y público con FIFA13, EA podría encontrarse ante un gran problema a la hora de repetir el éxito conseguido con su anterior entrega pero sorprendentemente el equipo desarrollador de FIFA considera que “Todavía no hemos visto nada” y por lo que hemos podido observar en la presentación de este nuevo FIFA es cierto.

El equipo desarrollador de FIFA se ha planteado cuales son las claves a la hora de desarrollar un partido de fútbol y trata de plasmarlas con el mayor realismo posible dentro de su nuevo simulador. En palabras de David Rutter, Productor Ejecutivo del videojuego, “En FIFA 14 se jugará a fútbol como en los grandes partidos: construyendo las jugadas desde atrás, viviendo con intensidad cada movimiento a medida que se crean oportunidades y dando lugar a goles increíbles”.

Importantes novedades en la jugabilidad

Disparo en Estado Puro introduce cambios a la hora de finalizar una jugada provocando que la inteligencia artificial de los futbolistas se ajuste a la perfección para encontrar la mejor posición de disparo. Los nuevos estilos de disparo incluyen un golpeo perfecto del balón, disparos forzados y tiros complejos. Además, la nueva Física Real del Balón, calcula la dirección del esférico para que los futbolistas lo golpeen con fuerza desde la distancia, realicen tiros ascendentes con precisión y acierten en disparos complicados, exactamente igual que ocurre en el fútbol real.

Cuatro nuevas características de juego

Crea oportunidades y controla el ritmo del partido gracias a cuatro nuevas opciones: La Protección del Balón te permitirá bloquear y esquivar a los defensas o ganar la posición al recibir un pase haciendo un control orientado; La Inteligencia del Compañero ha sido mejorada en defensa para que tu equipo reconozca en qué momento tiene que presionar con el fin de recuperar el esférico, y en ataque ofreciendo más recursos a los delanteros para superar a sus oponentes; Los Giros en Carrera con Balón permiten girar en cualquier dirección cuando se esprinta, aumentando el control y la confianza en los duelos uno contra uno; El Nuevo Sistema de Conducción del Balón introduce variedad en el toque del balón cuando el jugador está en carrera, siendo los futbolistas de mayor calidad los que tienen mejor control del balón.

Red de ojeadores

Con la Red Global de Ojeadores, disponible en el Modo Carrera, conocerás el interesante mundo de los ojeadores profesionales, desarrollando una red con la que encontrar nuevos talentos cada temporada. Los ojeadores evaluarán futbolistas de todo el mundo para analizar sus atributos y considerar su posible fichaje. Además, la nueva interfaz ofrecerá una navegación sencilla por los menús, con informes de ojeador en tiempo real y con menos interrupciones.

Confirmado Splinter Cell Blacklist en WiiU

Ubisoft confirma que Tom Clancy’s Splinter Cell® Blacklist™ estará disponible para Wii U el 20 de agosto en EE.UU., el 22 de agosto en territorios EMEA, y el 23 de agosto en Reino Unido. Tom Clancy’s Splinter Cell® Blacklist™ para la consola Wii U ofrecerá una experiencia de juego que pondrá a los jugadores en la piel del agente especial y director de 4th Echelon, Sam Fisher. Tom Clancy’s Splinter Cell® Blacklist™ ofrecerá un estilo de juego mejorado gracias al uso del Wii U GamePad, ya que éste permitirá a los jugadores utilizar dispositivos innovadores, ejecutar acciones de muerte en movimiento con gran eficacia para acabar con los enemigos y moverse por el escenario al mismo tiempo, además de un intuitivo sistema de cambio de arma, entre otras opciones. La pantalla táctil del GamePad, junto con los sistema de detección de movimiento lograrán que la inmersión de los fans y jugadores en esta moderna emocionante aventura sea total.